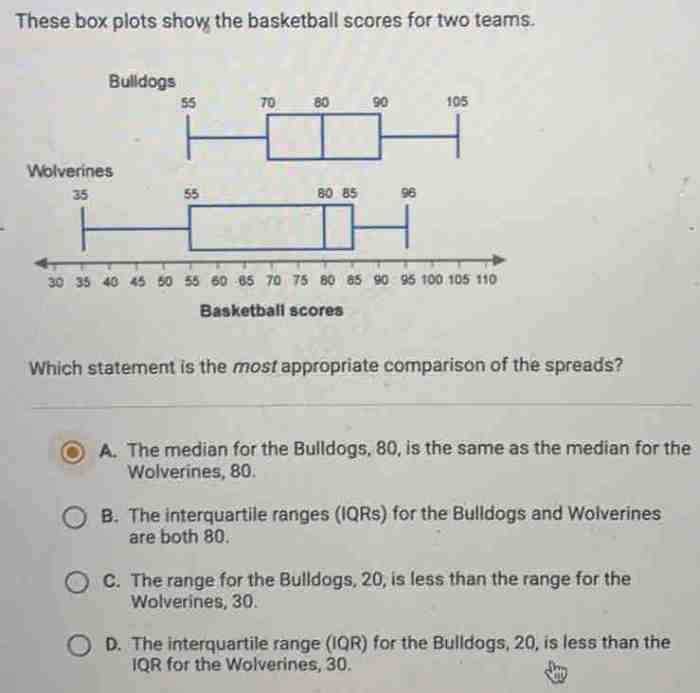

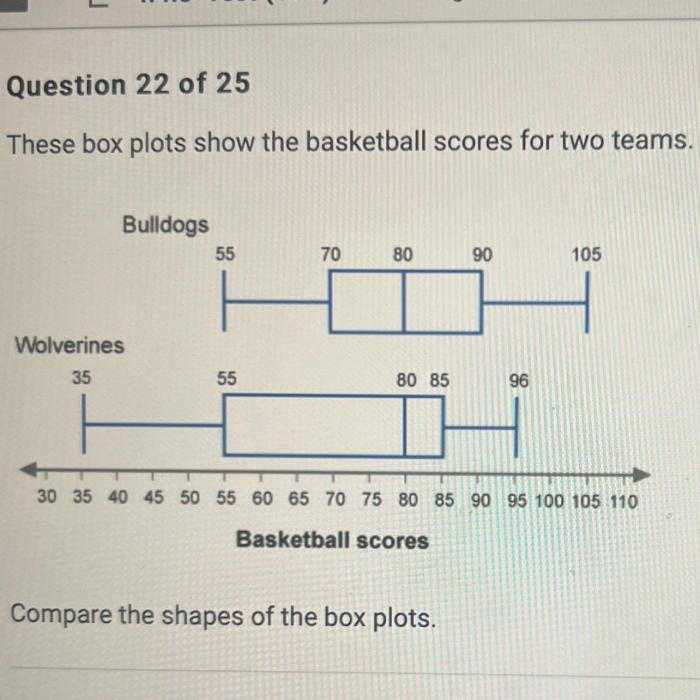

In the realm of financial markets, spreads play a pivotal role in shaping investment decisions. Which statement is the most appropriate comparison of the spreads? This question ignites a quest for understanding the intricacies of spread analysis, unlocking valuable insights into market dynamics and trading opportunities.

Spreads, the difference between two related financial instruments, provide a window into market sentiment and risk appetite. By comparing spreads across different types of assets, investors can gain a comprehensive view of market conditions and identify potential trading strategies.

Spreads in Financial Markets: Which Statement Is The Most Appropriate Comparison Of The Spreads

In financial markets, spreads refer to the difference between two related prices or interest rates. They provide insights into market conditions, liquidity, and risk appetite.

Different types of spreads include:

- Bid-ask spread:The difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask).

- Yield spread:The difference between the interest rates on two bonds with similar maturities but different credit ratings.

- Credit spread:The difference between the interest rate on a corporate bond and a government bond with the same maturity.

Factors affecting the size of spreads include market liquidity, supply and demand, and perceived risk.

Comparison of Spreads

Different types of spreads vary in size, liquidity, and risk:

| Type | Size | Liquidity | Risk |

|---|---|---|---|

| Bid-ask spread | Small | High | Low |

| Yield spread | Variable | Moderate | Moderate |

| Credit spread | Large | Low | High |

Bid-ask spreads are typically small and highly liquid, making them suitable for short-term trading. Yield spreads provide insights into interest rate expectations and market sentiment. Credit spreads reflect the perceived creditworthiness of issuers.

Case Study: Spread Analysis

Consider the spread between the yield on the 10-year US Treasury bond and the yield on the 10-year corporate bond of XYZ Corporation.

Factors influencing the spread include:

- Credit rating of XYZ Corporation

- Market volatility

- Economic conditions

By analyzing the historical performance of this spread, investors can gain insights into the market’s perception of XYZ Corporation’s credit risk and the overall economic outlook.

Applications of Spread Analysis

Spread analysis plays a crucial role in investment decision-making:

- Identifying trading opportunities:Spreads can signal potential profit opportunities, such as when the bid-ask spread is unusually wide.

- Assessing risk:Yield spreads can provide insights into market expectations and risk appetite, while credit spreads reflect the perceived creditworthiness of issuers.

- Portfolio management:Spread analysis can help investors diversify portfolios and manage risk by allocating assets across different types of spreads.

However, it’s important to note the limitations of spread analysis, such as the potential for spreads to narrow or widen rapidly due to market events.

Expert Answers

What are the key factors that affect the size of spreads?

Liquidity, credit risk, market volatility, and supply and demand are among the primary factors that influence spread size.

How can spread analysis be used to identify trading opportunities?

By comparing spreads across different assets, investors can identify mispricings and potential trading opportunities that exploit market inefficiencies.

What are the limitations of spread analysis?

Spread analysis is subject to market fluctuations and may not always accurately predict future market movements. It should be used in conjunction with other investment analysis techniques.