A recent leveraged buyout was financed with m – A recent leveraged buyout (LBO) financed with $50 million has sparked significant interest among financial professionals and investors alike. This transaction exemplifies the complexities and potential rewards associated with LBOs, a financing technique that has gained prominence in recent years.

This comprehensive analysis delves into the details of this LBO, examining its financing structure, key factors influencing the decision-making process, and broader market implications.

Leveraged buyouts involve the acquisition of a company using a significant amount of debt, often with the intention of restructuring or improving its operations. The recent LBO financed with $50 million provides a valuable case study for understanding the dynamics of LBOs, their impact on the market, and the regulatory considerations surrounding them.

Leveraged Buyout Overview: A Recent Leveraged Buyout Was Financed With m

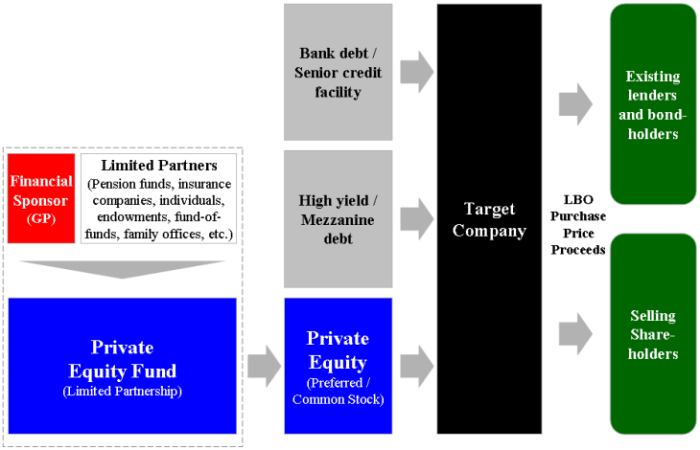

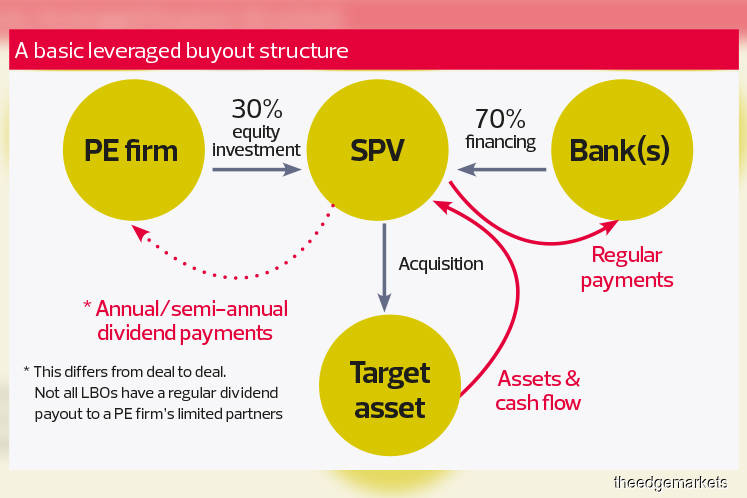

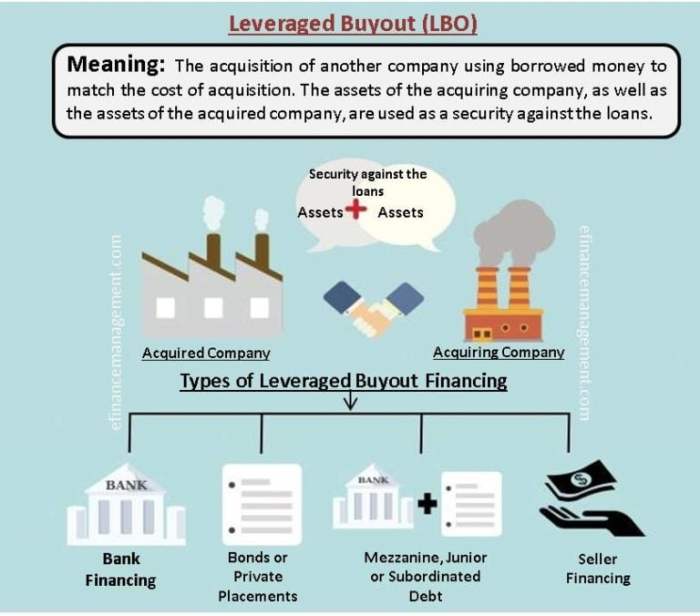

A leveraged buyout (LBO) is a transaction in which a company is acquired using a significant amount of debt. The debt is typically secured by the assets of the acquired company. LBOs are often used by private equity firms to acquire companies that are undervalued or have potential for growth.

Some typical examples of LBO transactions include the acquisition of RJR Nabisco by Kohlberg Kravis Roberts & Co. in 1988 and the acquisition of Toys “R” Us by Bain Capital in 2005.

Benefits and Risks of LBOs, A recent leveraged buyout was financed with m

LBOs can offer a number of benefits to the acquiring company, including:

- Increased leverage: LBOs allow companies to acquire assets with a higher degree of leverage than would be possible through traditional financing methods.

- Tax benefits: Interest payments on debt are tax-deductible, which can reduce the overall cost of the acquisition.

- Potential for growth: LBOs can provide companies with the capital they need to invest in growth initiatives.

However, LBOs also come with a number of risks, including:

- Increased debt burden: LBOs can significantly increase a company’s debt burden, which can make it more difficult to meet financial obligations.

- Reduced flexibility: LBOs can limit a company’s ability to make strategic decisions, as they may be constrained by the terms of the debt agreement.

- Potential for bankruptcy: If a company is unable to meet its debt obligations, it may be forced into bankruptcy.

FAQ Guide

What are the key benefits of leveraged buyouts?

LBOs offer potential benefits such as increased financial leverage, enhanced returns for investors, and opportunities for operational improvements.

What are the potential risks associated with leveraged buyouts?

LBOs carry risks such as high debt levels, potential financial distress, and the need for strong management to navigate the complexities of the transaction.

How do regulatory considerations impact leveraged buyouts?

Regulatory considerations, such as debt covenants and industry-specific regulations, can influence the structure and execution of LBOs, impacting the risk profile and potential returns.