Delving into the intricacies of inventory management, “Mastering Inventory Final Exam Answers” provides an authoritative exploration of the key concepts, principles, and techniques that underpin effective inventory management. This comprehensive guide empowers readers to navigate the complexities of inventory costing, valuation, and control, equipping them with the knowledge and skills to optimize their inventory strategies and achieve operational excellence.

Inventory Management Fundamentals

Inventory management is the process of managing the flow of goods from the point of origin to the point of consumption. The key concepts of inventory management include:

- Inventory levels: The amount of inventory on hand at any given time.

- Inventory turnover: The rate at which inventory is sold and replaced.

- Inventory carrying costs: The costs associated with holding inventory, such as storage, insurance, and obsolescence.

- Inventory optimization: The process of finding the optimal level of inventory to hold in order to minimize costs and maximize profits.

There are a number of different inventory management techniques that can be used to optimize inventory levels. Some of the most common techniques include:

- Just-in-time (JIT) inventory: A system in which inventory is only purchased when it is needed for production.

- Materials requirement planning (MRP): A system that uses computer software to plan and manage inventory levels based on production schedules.

- Safety stock: A buffer of inventory that is held to protect against unexpected increases in demand or disruptions in the supply chain.

Inventory optimization is important because it can help businesses to reduce costs, improve customer service, and increase profitability. By carefully managing inventory levels, businesses can avoid the costs of overstocking and understocking.

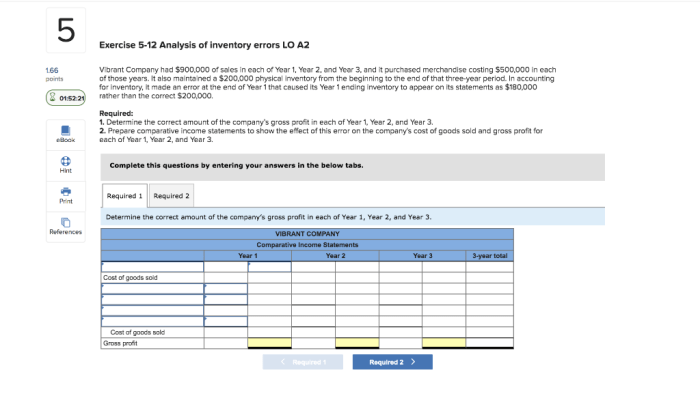

Inventory Costing Methods

Inventory costing methods are used to determine the cost of inventory for financial reporting purposes. The most common inventory costing methods include:

- First-in, first-out (FIFO): This method assumes that the oldest inventory is sold first.

- Last-in, first-out (LIFO): This method assumes that the newest inventory is sold first.

- Weighted average: This method assumes that the cost of inventory is the average cost of all inventory on hand.

The choice of inventory costing method can have a significant impact on the financial statements of a business. For example, FIFO will result in higher cost of goods sold and lower net income during periods of rising prices, while LIFO will result in lower cost of goods sold and higher net income during periods of rising prices.

The advantages and disadvantages of each inventory costing method are as follows:

| Inventory Costing Method | Advantages | Disadvantages |

|---|---|---|

| FIFO | – Matches the physical flow of inventory.

|

– Can result in higher cost of goods sold and lower net income during periods of rising prices.

|

| LIFO | – Can result in lower cost of goods sold and higher net income during periods of rising prices.

|

– Does not match the physical flow of inventory.

|

| Weighted average | – Provides a more stable cost of goods sold and net income over time.

|

– Does not match the physical flow of inventory.

|

Inventory Valuation and Reporting

Inventory valuation is the process of determining the value of inventory for financial reporting purposes. The most common inventory valuation methods include:

- Lower of cost or market (LCM): This method values inventory at the lower of its cost or its market value.

- Net realizable value (NRV): This method values inventory at its estimated selling price minus any costs to complete and sell the inventory.

The choice of inventory valuation method can have a significant impact on the financial statements of a business. For example, LCM will result in a lower value for inventory and a lower net income during periods of declining prices, while NRV will result in a higher value for inventory and a higher net income during periods of declining prices.

Inventory reporting is the process of disclosing information about inventory in the financial statements. The most common inventory reporting methods include:

- Periodic inventory system: This system requires businesses to take a physical inventory at the end of each accounting period.

- Perpetual inventory system: This system tracks inventory levels on a continuous basis.

The choice of inventory reporting method can have a significant impact on the accuracy and timeliness of inventory information. For example, a periodic inventory system can result in less accurate inventory information than a perpetual inventory system, but it can also be less expensive to implement.

Inventory Control and Management: Mastering Inventory Final Exam Answers

Inventory control is the process of managing inventory levels to minimize costs and maximize profits. The most common inventory control techniques include:

- Inventory forecasting: This technique uses historical data and other information to predict future demand for inventory.

- Safety stock: This technique involves holding a buffer of inventory to protect against unexpected increases in demand or disruptions in the supply chain.

- ABC analysis: This technique classifies inventory items into three categories (A, B, and C) based on their value and usage. A-items are the most valuable and should be closely controlled, while C-items are the least valuable and can be controlled less tightly.

- Just-in-time (JIT) inventory: This technique involves holding only the inventory that is needed for production. JIT can help to reduce inventory costs and improve efficiency.

Inventory management is important because it can help businesses to reduce costs, improve customer service, and increase profitability. By carefully managing inventory levels, businesses can avoid the costs of overstocking and understocking.

Inventory Forecasting and Planning

Inventory forecasting is the process of predicting future demand for inventory. The most common inventory forecasting techniques include:

- Historical data analysis: This technique uses historical data to predict future demand.

- Trend analysis: This technique uses trend lines to predict future demand.

- Seasonal analysis: This technique uses seasonal patterns to predict future demand.

- Econometric models: These models use economic data to predict future demand.

Inventory planning is the process of using inventory forecasts to make decisions about inventory levels. The most common inventory planning techniques include:

- Safety stock planning: This technique involves determining the amount of safety stock to hold to protect against unexpected increases in demand or disruptions in the supply chain.

- Production planning: This technique involves planning production schedules to ensure that inventory levels are sufficient to meet demand.

- Purchasing planning: This technique involves planning purchases to ensure that inventory levels are sufficient to meet demand.

Inventory forecasting and planning are important because they can help businesses to reduce costs, improve customer service, and increase profitability. By carefully forecasting demand and planning inventory levels, businesses can avoid the costs of overstocking and understocking.

General Inquiries

What is the importance of inventory optimization?

Inventory optimization is crucial for businesses to maintain optimal inventory levels, minimize costs, and enhance customer satisfaction. By optimizing inventory, businesses can avoid stockouts, reduce waste, and improve cash flow.

How does inventory valuation impact financial statements?

Inventory valuation methods directly impact the reported value of inventory on a company’s financial statements. Different valuation methods result in varying inventory values, which can affect profitability, asset values, and tax liability.

What are the advantages of using the FIFO inventory costing method?

The FIFO (First-In, First-Out) method assumes that the oldest inventory items are sold first. Advantages of FIFO include matching current costs with current revenue, reducing the risk of obsolete inventory, and providing a more accurate representation of inventory value during periods of inflation.